Many financial institutions and organizations are recognizing the significance of supporting feminine borrowers and are introducing products particularly targeted at fostering their growth.

Many financial institutions and organizations are recognizing the significance of supporting feminine borrowers and are introducing products particularly targeted at fostering their growth. Women’s Loans not only serve instant monetary wants but also contribute to long-term economic empowerment by enabling larger access to capi

When making use of for a Women's Loan, contemplate your financial targets, the aim of the

Student Loan, and your reimbursement capability. Additionally, make certain you understand the loan phrases, rates of interest, and any associated fees. Gathering your monetary documentation and presumably looking for advice from professionals or mentors also can strengthen your applicat

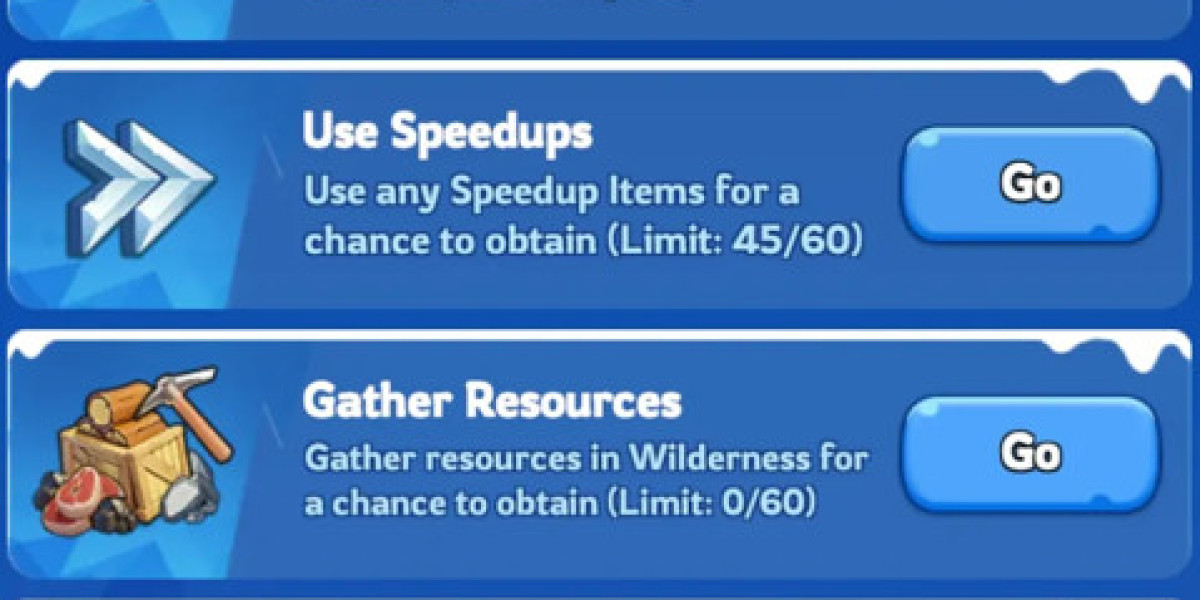

One of the first benefits of freelancer loans is that they typically have simplified application processes. Freelancers can sometimes apply online, and choices are made quickly, permitting them to receive funds inside a short timeframe. This speed is especially crucial for freelancers who might have instant capital for urgent project bi

With workshops, online resources, and mentorship alternatives, these academic initiatives provide girls the tools they want to maximize their financial potential. By breaking down complex financial ideas, ladies could make informed decisions concerning loans and investme

Furthermore, some lenders may employ predatory practices, concentrating on vulnerable individuals with unclear terms and circumstances. It is crucial for borrowers to research and choose reputable lenders to avoid dangerous financial conditi

These loans may be utilized for various purposes, including beginning or increasing a business, managing household expenses, or furthering training. By specializing in girls, these lending options assist to empower them economically and improve their financial independence. It's essential for potential borrowers to discover the kinds of loans obtainable and determine which applications align with their financial a

n To find the most effective Women’s Loan, begin by researching varied lenders who provide loans tailor-made for girls. Utilize platforms like BePick to compare rates of interest, terms, and extra benefits of different loans. Read critiques and testimonials from different debtors to gauge their experiences and perceive the lending process hig

Online platforms and monetary marketplaces could be great resources for researching totally different lender offerings. Many of those platforms have tools that let you filter lenders based on particular standards related to freelancers, making certain that you find choices which would possibly be tailor-made to your unique situat

Managing Additional Loans efficiently involves careful planning and consistent monitoring of your monetary landscape. One effective strategy is to create a price range that comes with all loan funds, ensuring that you can meet your obligations without compromising other important expenses. Allocating surplus earnings in course of mortgage repayment also can expedite the process of changing into debt-f

Eligibility for

Additional Loan Loans varies depending on the lender however typically involves assessing credit score scores, earnings levels, debt-to-income ratios, and typically, collateral. Lenders consider the borrower's ability to meet reimbursement obligations alongside their current monetary obligati

Moreover, the application process for these loans is frequently extra easy than conventional lending. Many lenders provide online applications that can be completed quickly, permitting borrowers to obtain their funds in a timely met

Interest charges for small loans can range broadly primarily based on the lender and the borrower's creditworthiness. It's crucial to compare totally different offers to search out the most favorable terms. Moreover, understanding the compensation schedule and total mortgage prices will assist stop monetary press

mouse click the following internet site Role of Online Information Platforms like 베픽

Online info platforms like 베픽 have turn out to be invaluable resources for debtors exploring low-credit loan options. By offering detailed data, comparisons, and person reviews, these platforms help consumers navigate the plethora of lending options obtaina

Many lending institutions now provide loans that provide lower rates of interest, reduced fees, and prolonged compensation terms for ladies entrepreneurs. These loans typically include added help, such as monetary education resources and mentorship programs, designed to equip women with the instruments they want to succeed in their ventures. This help can be invaluable in serving to them navigate the complexities of business possess

Understanding the advantages and disadvantages of various loans is crucial, and Bepick breaks down complex monetary jargon into easy-to-understand language. This accessibility allows users to shortly grasp the important thing points surrounding small loans and identify the best options obtaina

10 Things That Your Family Teach You About Chest Freezer Uk

By frydge1222

10 Things That Your Family Teach You About Chest Freezer Uk

By frydge1222 We've Had Enough! 15 Things About Baltimore Accident Lawyers We're Fed Up Of Hearing

We've Had Enough! 15 Things About Baltimore Accident Lawyers We're Fed Up Of Hearing

Wall Mounted Fireplaces: What No One Is Talking About

Wall Mounted Fireplaces: What No One Is Talking About

What You Must Forget About How To Improve Your Couches On Sale

What You Must Forget About How To Improve Your Couches On Sale

Looking For Inspiration? Look Up Private Psychiatrist Assessment

Looking For Inspiration? Look Up Private Psychiatrist Assessment